Part four analyzing transactions into debit and credit parts – Embarking on part four of our exploration, we delve into the intricate world of analyzing transactions through the lens of debits and credits. This fundamental accounting concept serves as the backbone of financial recording, enabling us to dissect the flow of economic events with precision.

By unraveling the nature of debit and credit transactions, we gain invaluable insights into the financial health of an organization. This understanding empowers us to make informed decisions, ensuring the accuracy and reliability of our accounting practices.

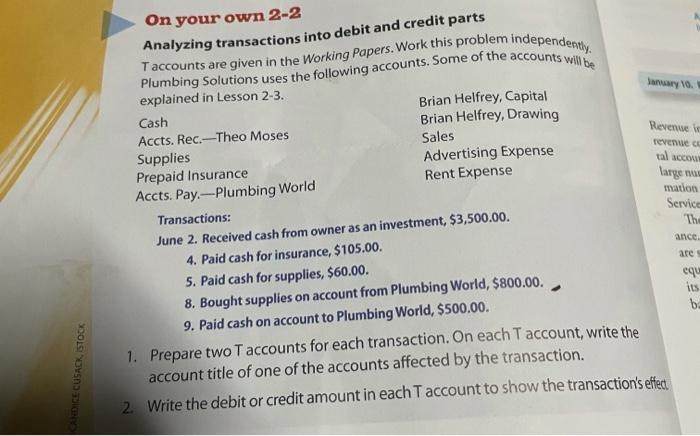

Understanding Debit and Credit Transactions

Debit and credit transactions are fundamental concepts in accounting that represent the flow of value into and out of accounts. Understanding their roles is crucial for accurate financial reporting and analysis.

In accounting, debits increase asset and expense accounts, while decreasing liability, equity, and revenue accounts. Credits, on the other hand, increase liability, equity, and revenue accounts, while decreasing asset and expense accounts.

For instance, when a company purchases inventory, the Inventory account is debited (increased) to record the asset’s value. Simultaneously, the Cash account is credited (decreased) to reflect the outflow of funds used to acquire the inventory.

Analyzing Transactions into Debit and Credit Parts: Part Four Analyzing Transactions Into Debit And Credit Parts

To analyze transactions into debit and credit parts, it’s essential to identify the accounts affected and determine whether the transaction increases or decreases their balances.

Consider the following transaction: A company sells merchandise on account for $1,000.

- Accounts Receivable is debited (increased) for $1,000 to record the receivable created from the sale.

- Sales Revenue is credited (increased) for $1,000 to recognize the revenue earned from the sale.

Using Debit and Credit Rules

The debit and credit rules provide guidance on how to record transactions based on the type of account involved.

- Assets:Debited to increase, credited to decrease

- Liabilities:Credited to increase, debited to decrease

- Equity:Credited to increase, debited to decrease

- Revenue:Credited to increase, no debit

- Expenses:Debited to increase, no credit

These rules ensure that the accounting equation (Assets = Liabilities + Equity) remains balanced after each transaction.

Creating an HTML Table to Summarize Transactions

To summarize transactions, an HTML table can be created with four columns: Transaction, Account, Debit, and Credit.

| Transaction | Account | Debit | Credit |

|---|---|---|---|

| Purchased inventory on account | Inventory | $1,000 | – |

| Sold merchandise on account | Accounts Receivable | $1,000 | – |

| – | Sales Revenue | – | $1,000 |

This table provides a concise summary of the transactions and their impact on the respective accounts.

Question Bank

What is the purpose of analyzing transactions into debit and credit parts?

Analyzing transactions into debit and credit parts allows us to maintain the accounting equation (Assets = Liabilities + Equity) and ensure the accuracy and completeness of financial records.

How do I determine whether a transaction is a debit or credit for a particular account?

The rules for debiting and crediting accounts vary depending on the account type. For example, assets increase with debits and decrease with credits, while liabilities increase with credits and decrease with debits.

Why is it important to understand the debit and credit rules?

Understanding the debit and credit rules is crucial for ensuring the accuracy and reliability of financial statements. By following these rules, we can ensure that transactions are recorded correctly and that the accounting equation remains balanced.