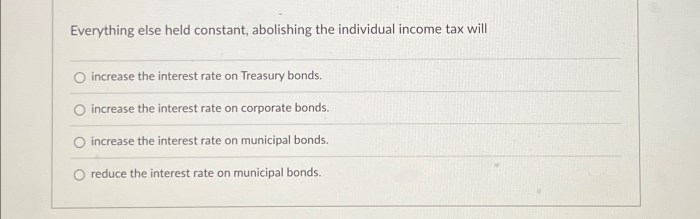

Everything else held constant abolishing the individual income tax will – With everything else held constant, abolishing the individual income tax would have significant economic, social, and political implications. This article explores the potential impact of this policy change, examining its effects on consumer spending, business investment, government revenue, income inequality, charitable giving, and social safety net programs.

The article also considers the political feasibility of abolishing the individual income tax, identifying potential obstacles and opportunities. Additionally, it compares alternative revenue sources to the individual income tax and discusses lessons learned from countries that have abolished or significantly reduced their individual income tax.

Economic Effects

Abolishing the individual income tax would have significant economic consequences, including:

Impact on Consumer Spending

- Increased consumer spending due to higher disposable income.

- Potential for higher inflation due to increased demand.

Business Investment

- Increased business investment due to reduced tax burden.

- Potential for increased economic growth and job creation.

Government Revenue

- Substantial loss of government revenue.

- Need for alternative revenue sources to maintain government services.

Social Implications

Abolishing the individual income tax would also have important social implications, such as:

Income Inequality

- Reduced income inequality due to the elimination of progressive taxation.

- Potential for increased wealth concentration.

Charitable Giving

- Reduced charitable giving due to lower tax incentives.

- Potential for negative impact on non-profit organizations.

Social Safety Net Programs

- Reduced funding for social safety net programs due to lower government revenue.

- Potential for increased poverty and social inequality.

Political Considerations

Abolishing the individual income tax would be a politically contentious issue, with:

Political Feasibility

- Strong opposition from groups that benefit from the tax, such as social welfare programs.

- Potential for political backlash from taxpayers who would see their taxes increase.

Potential Political Obstacles and Opportunities

- Public support for tax reform could create an opportunity for political action.

- Political polarization could make it difficult to reach consensus on a replacement revenue source.

Role of Public Opinion, Everything else held constant abolishing the individual income tax will

- Public opinion is generally divided on the issue, with strong support and opposition.

- Policymakers must consider public opinion when making decisions about tax reform.

Alternative Revenue Sources: Everything Else Held Constant Abolishing The Individual Income Tax Will

| Alternative Revenue Source | Pros | Cons |

|---|---|---|

| Sales Tax | Broad tax base, relatively easy to administer | Regressive, can be inflationary |

| Value-Added Tax (VAT) | Broad tax base, reduces tax evasion | Complex to administer, can be inflationary |

| Corporate Income Tax | Targets businesses, can promote investment | Can lead to tax avoidance, may not be sufficient revenue |

| Wealth Tax | Targets wealthy individuals, reduces wealth inequality | Difficult to administer, can lead to capital flight |

International Comparisons

| Country | Individual Income Tax Rate |

|---|---|

| United States | 10%

|

| Canada | 15%

|

| United Kingdom | 20%

|

| Australia | 19%

|

| Germany | 14%

|

Lessons from countries that have abolished or significantly reduced their individual income tax:

- Economic growth can increase, but so can income inequality.

- Alternative revenue sources must be carefully considered.

- Public support is crucial for successful implementation.

Commonly Asked Questions

What are the potential economic effects of abolishing the individual income tax?

Abolishing the individual income tax could lead to increased consumer spending and business investment, but it could also reduce government revenue.

What are the potential social implications of abolishing the individual income tax?

Abolishing the individual income tax could reduce income inequality and increase charitable giving, but it could also have negative implications for social safety net programs.

What are the potential political considerations of abolishing the individual income tax?

Abolishing the individual income tax would be a major policy change that would require significant political support. There are both potential obstacles and opportunities to consider.