With fine print mortgage bill answer key at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Mortgage bills are complex financial documents that can be difficult to understand, especially the fine print. This guide provides a comprehensive overview of fine print clauses in mortgage bills, explaining their meaning, implications, and potential impact on mortgage terms.

Mortgage Bill Basics

A mortgage bill is a statement that Artikels the details of a mortgage loan. It includes information such as the amount of the loan, the interest rate, the loan term, and the monthly payment amount. Mortgage bills are typically sent to borrowers on a monthly basis.

The key components of a mortgage bill include:

- Principal:The amount of the loan that is still owed.

- Interest:The charge for borrowing the money.

- Taxes:The amount of property taxes that are due on the property.

- Insurance:The amount of homeowners insurance that is due on the property.

Fine Print in Mortgage Bills

The fine print in a mortgage bill is the small print that is often found at the bottom of the page. This fine print contains important information about the loan, such as the terms and conditions of the loan, the fees and charges that may be associated with the loan, and the rights and responsibilities of the borrower.

Lenders include fine print in mortgage bills to protect themselves from legal liability. The fine print ensures that borrowers are aware of all of the terms and conditions of the loan before they sign the agreement.

There are both potential risks and benefits to fine print for borrowers. On the one hand, the fine print can help borrowers to understand the terms of their loan and to make informed decisions about their mortgage. On the other hand, the fine print can be difficult to understand, and it may contain provisions that are不利to the borrower.

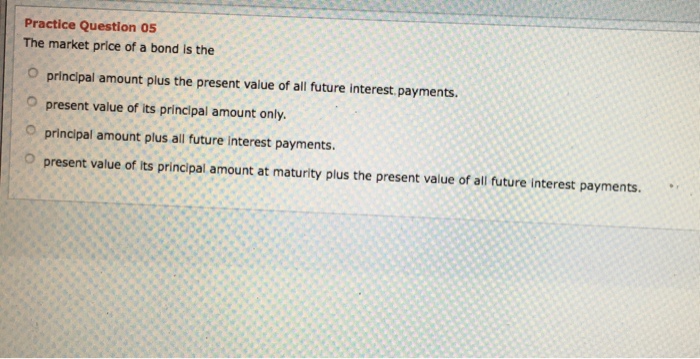

Understanding Fine Print Clauses

There are a number of common fine print clauses that are found in mortgage bills. These clauses include:

| Clause | Meaning | ||

|---|---|---|---|

| Prepayment penalty: This clause penalizes borrowers who pay off their loan early. | Late payment fee: This clause charges borrowers a fee if they make a late payment. | Default interest rate: This clause increases the interest rate on the loan if the borrower defaults on the loan. | Acceleration clause: This clause allows the lender to demand full payment of the loan if the borrower defaults on the loan. |

It is important for borrowers to understand the meaning and implications of each of these clauses before they sign a mortgage agreement.

Impact of Fine Print on Mortgage Terms

Fine print clauses can have a significant impact on the overall terms of a mortgage. For example, a prepayment penalty can make it more expensive for borrowers to pay off their loan early. A late payment fee can make it more difficult for borrowers to stay current on their mortgage payments.

A default interest rate can increase the cost of the loan if the borrower defaults on the loan. An acceleration clause can allow the lender to demand full payment of the loan if the borrower defaults on the loan.

It is important for borrowers to carefully review the fine print clauses in a mortgage agreement before they sign the agreement. These clauses can have a significant impact on the cost of the loan and the rights and responsibilities of the borrower.

Tips for Navigating Fine Print: Fine Print Mortgage Bill Answer Key

Here are some tips for navigating fine print:

- Read the fine print carefully.Don’t just skim over the fine print. Take your time and read each clause carefully.

- Ask questions.If you don’t understand something, ask your lender or a lawyer for clarification.

- Negotiate.If you don’t agree with a particular clause, you can try to negotiate with your lender.

- Get a second opinion.If you’re not sure about something, get a second opinion from a lawyer or a financial advisor.

By following these tips, you can make sure that you understand the fine print in your mortgage agreement and that you are making an informed decision about your mortgage.

Question & Answer Hub

What is the purpose of fine print in mortgage bills?

Lenders include fine print in mortgage bills to provide additional information and legal protections. These clauses can clarify the terms of the loan, define the rights and responsibilities of both the lender and borrower, and protect the lender in case of default.

What are some common fine print clauses found in mortgage bills?

Common fine print clauses include prepayment penalties, late payment fees, balloon payments, and acceleration clauses. These clauses can have a significant impact on the cost and terms of the mortgage.

How can I understand and negotiate fine print clauses?

To understand fine print clauses, read them carefully and consult with a lawyer or financial advisor if needed. You can also negotiate with the lender to modify or remove certain clauses that are not in your best interest.