Bond discount should be amortized to comply with – Bond discount amortization plays a crucial role in ensuring compliance with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). This accounting treatment involves gradually reducing the difference between the face value and purchase price of a bond over its life, resulting in a more accurate representation of the bond’s value on financial statements.

Understanding the concept of bond discount and its impact on financial ratios is essential for accountants and financial analysts. By amortizing bond discounts, companies can maintain accurate financial reporting and comply with established accounting standards, fostering transparency and reliability in financial markets.

Bond Discount Amortization: A Comprehensive Analysis: Bond Discount Should Be Amortized To Comply With

Bond discount occurs when a bond is issued at a price below its face value. This discount represents the present value of the interest payments and the principal repayment that will be made over the life of the bond. The accounting treatment of bond discount involves amortizing the discount over the bond’s life, resulting in a gradual increase in the bond’s carrying value and a decrease in interest expense.

Impact on Financial Ratios

Bond discount amortization affects financial ratios such as the debt-to-equity ratio and interest coverage ratio. Amortization reduces the bond’s carrying value, which in turn reduces the debt-to-equity ratio. Additionally, amortization increases interest expense, which reduces the interest coverage ratio. These effects can impact a company’s financial health and its ability to obtain financing.

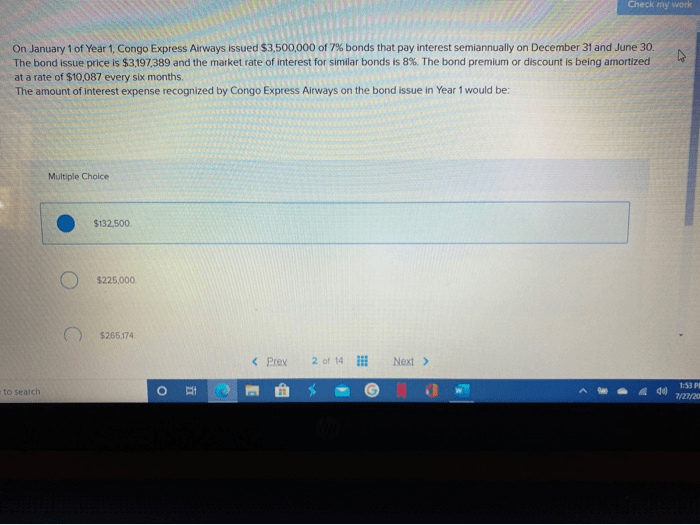

Example:If a company issues a $1,000,000 bond with a 5% coupon rate and a 10-year maturity at a discount of $10,000, the annual amortization would be $1,000. This would reduce the bond’s carrying value by $1,000 each year, and increase interest expense by $1,000 each year.

Compliance with GAAP and IFRS, Bond discount should be amortized to comply with

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) require companies to amortize bond discount over the life of the bond. This is because the discount represents a portion of the interest that will be paid over the life of the bond, and therefore should be recognized as interest expense.

Amortization helps companies comply with these accounting standards by ensuring that the bond’s carrying value reflects the present value of the future cash flows, and that interest expense is recognized in a systematic manner over the bond’s life.

Advantages and Disadvantages of Amortization

Advantages:

- Improved financial reporting accuracy and compliance with GAAP and IFRS.

- Provides a more accurate representation of the bond’s carrying value and interest expense.

Disadvantages:

- Increased complexity in accounting for bonds.

- Potential for earnings manipulation if amortization is not properly accounted for.

Alternative Accounting Methods

Alternative accounting methods for bond discount include:

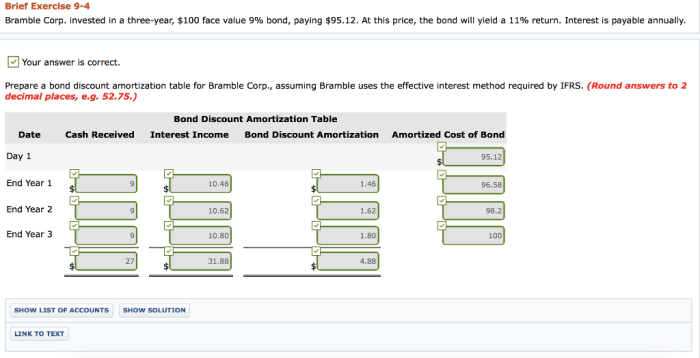

- Straight-line method:Amortizes the bond discount equally over the life of the bond.

- Effective interest method:Amortizes the bond discount based on the present value of the remaining interest payments.

The amortization method is generally preferred over the straight-line method because it provides a more accurate representation of the time value of money.

Real-World Examples

Example 1:In 2021, Apple Inc. issued $10 billion in 10-year bonds with a 2.5% coupon rate and a discount of $200 million. The annual amortization expense for these bonds is $20 million.

Example 2:In 2022, Microsoft Corp. issued $20 billion in 30-year bonds with a 3% coupon rate and a discount of $400 million. The annual amortization expense for these bonds is $13.3 million.

These examples illustrate how bond discount amortization affects the financial statements and financial ratios of real-world companies.

Popular Questions

What is the purpose of bond discount amortization?

Bond discount amortization aims to allocate the difference between the face value and purchase price of a bond over its life, resulting in a more accurate representation of the bond’s value on financial statements.

How does bond discount amortization affect financial ratios?

Amortizing bond discounts can impact financial ratios such as the debt-to-equity ratio and interest coverage ratio, potentially improving the company’s financial profile.

What are the advantages of bond discount amortization?

Advantages include improved financial reporting accuracy, compliance with accounting standards, and potential reduction in earnings manipulation.